It is fall 2013, and contra the expectations of two years ago, the most-watched campaign this political season is not the off-cycle election for New Jersey’s governor. Instead, all eyes are on President Obama’s choice for chairperson of the Federal Reserve, a position that will soon be vacated by Ben S. Bernanke ’75 after nearly eight years in office. The successor will be one of two individuals—Janet Yellen, current vice chairwoman of the Federal Reserve, or Larry Summers, former Secretary of the Treasury, chairman of the National Economic Council, and president of Harvard University.

In terms of who would perform a better job keeping the Fed’s monetary policy on track, we believe both candidates are viable options. While Yellen’s views on central banking are well known from her current position as vice chairwoman and from her time as the president and CEO of the Federal Reserve Bank of San Francisco, Summers’s ideas about national monetary policy are more opaque to the general public. Yet both qualify as members of the New Keynesian school of economics, and there is no reason to believe there to be major differences in policy between the two figures. Both are inflation doves, subscribing to the opinion that curbing inflation is not as important to the national economy as weak output and growth.

But Summers’s history—notably as president of Harvard from 2001 to 2006—gives us reservations about his ability to helm the world’s most powerful economic institution. He has a history of brusque and controversial statements, such as his comment about differences in mathematical and scientific ability between men and women that cost him his prestigious job here in Cambridge. Part of the responsibility of Fed chairman is to keep the markets calm, and we have doubts that the colorful Summers can maintain the staid and sober disposition necessary for the position.

Summers’s leadership style also gives us pause. While some tread lightly in observing, “his widely acknowledged intellect is offset by imperiousness that makes him hard to work with,” others have gone so far as to term him a “bull in a china shop.” He has also been accused of creating a hostile environment for female employees. At Harvard, Summers faced controversy for his dispute with African American studies professor Cornel West.

Janet Yellen simply lacks the baggage that will make Summers’s job more difficult on day one, and she benefits, by all accounts, of her technocratic, Bernanke-esque demeanor. There are enough reports of Summers’s explosive management style to suggest that Yellen would be the far safer and more sensible choice.

Read more in Opinion

What Miss Utah Should've SaidRecommended Articles

-

Alum and Harvard Board of Overseers Member Steps Down as Vice Chair of Federal Reserve BoardRoger W. Ferguson ’73, a member of the Harvard Board of Overseers, announced his resignation from his position as vice

-

Roundtable: Would Larry Summers have made a better Fed Chair than Janet Yellen?If Summers's stormy tenure at Harvard—from the Shleifer shadiness, Cornel West debacle, or HMC disaster to name a few—is any indication of his brash attitude, then it is clear to me that Yellen would be the better chair.

-

Long Live the QueenYellen has the ability to strengthen the outlook of multiple currencies at the same time.

-

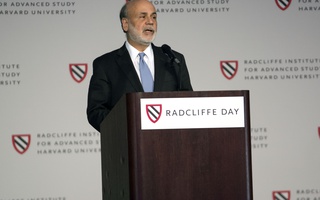

Janet Yellen to Receive Radcliffe Medal in MayJanet L. Yellen, Chair of the Board of Governors of the Federal Reserve System, will receive the Radcliffe Medal in May in recognition of her work in guiding the nation’s economy.

-

Federal Reserve Chair Yellen Awarded Radcliffe Medal

Federal Reserve Chair Yellen Awarded Radcliffe Medal