Summers Inspired Uncertainty—He Will Be Missed

With Larry Summers out of the race for the Federal Reserve chairmanship, the future of American monetary policy is looking more certain than it did a week ago. That may not be a good thing.

Predictability is exactly what many financial market participants have been hoping to see in President Obama’s choice for the Fed. Markets tanked when Summers surfaced as a serious contender and rallied when Janet Yellen recently re-emerged as the frontrunner. Traders, however, are notoriously short-sighted; in evaluating which candidate would be the best pick, it is important to look well beyond any immediate market implications.

The policy issue that has preoccupied markets since June is the question of how and when the Fed will taper its bond-buying program—and, in doing so, take the first step toward an eventual tightening of monetary policy. Needless to say, the contender seen as less likely to alter the current regime and introduce any policy surprises—namely, Yellen—has been able to line up support across the board. Solving our economic woes, however, is not merely a matter of staying the course and perpetually injecting cash into the financial system.

Having taken the current program of quantitative easing to its logical end, we are in need of new (and possibly unconventional) policies to stimulate growth. The set of possibilities ranges from placing a greater focus on fiscal policy to increasing inflation expectations by, as Paul Krugman has characterized it, “credibly committing to irresponsible future monetary policy.” Setting aside the debate over exactly which policy choices are advisable, the point is that predictable, immediately market-soothing policies may not be the ones which will do the most to bolster America’s long-term economic health.

Larry Summers was an easy target for detractors and earned no favor with the markets for his perceived hawkish stance. Ignored amid criticism of his supposed “unpredictability” was the implication that he might also be willing to stray from the beaten path and advocate forcefully for needed policy shifts. The future is looking more certain now that the Fed Chair nomination is converging around Yellen, but that is not to say that widely anticipated dovish conventional monetary policy will make for a better ultimate outcome than the harder-to-anticipate new policies that Summers may have put in place.

If Yellen is appointed as Fed Chair, she will likely implement a stable policy trajectory. We will never know how a Summers chairmanship would have unfolded, but the policy outlook would have initially been uncertain—and that may have ultimately had positive implications for the economic recovery.

Andrew C. Das Sarma '15 is a physics concentrator in Eliot House. He is co-president of the Harvard Undergraduate Economics Association.

Don’t Punish a Slip-Up

A few days ago, Larry Summers removed his name from consideration to replace Ben Bernanke as head of the Federal Reserve. Opposed by a broad coalition of progressives, the Harvard professor and Clinton-era Treasury secretary's ambitions were done in mostly by his neoliberal economic outlook, which leftists maintain was repudiated by the 2008 mortgage meltdown.

While I join them in happiness to see Summers go—and cheer the probable appointment of his chief rival Janet Yellen—I disagree with those on the left who resisted Summers' ascension due to unfortunate remarks he made about women in math and science during his tenure as president of Harvard University.

Summers, whose administration was marked—and marred—by controversy, stated, in 2005, that disparities between men and women in those fields could be explained in part by innate differences between the sexes. His faux pas, along with other missteps, cost him his post the following year.

That might have been how things should pan out at a university, but I find it ludicrous that gender politics should intrude on the workings of the Federal Reserve, an institution that in principle stands above petty hatreds to regulate the money supply and rationalize the American economy.

Comments such as those made by Summers should only be taken into consideration when they express beliefs that could impact policy decisions, or when they display ugly, deep-seated prejudice. That his slip-up met neither of these tests and was still held against him must concern fair-minded people.

Daniel J. Solomon ’16 is a Crimson editorial writer in Pforzheimer House.

Summers Is(n't) Coming

Appointing Larry Summers for Federal Reserve chair would have been a political disaster for President Obama. Summers had already earned the "no" votes of three Democratic members of the Senate Banking Committee by the time he voluntary withdrew, citing a possible "acrimonious" confirmation process. Amid serious difficulties with Syria, government shutdowns, and debt defaults, Obama simply had no political capital left to expend on his friend and close advisor.

Though Summers is an eminent economist, the public has little knowledge of his views on monetary policy as compared to Janet Yellen's near 10 years as a member of the Federal Reserve's Board of Governors. But the new Fed chair would not just dole out interest rates. The Fed is one of the chief regulators of the banking industry, and Summers' lucrative consulting gigs with Citigroup and legacy of deregulation of derivatives during the Clinton era that worsened the financial crisis are far from comforting.

Though Fed chairs are expected to be exceptional economists, their job is mostly done through finding consensus with the Board of Governors. If Summers's stormy tenure at Harvard—from the Shleifer shadiness, Cornel West debacle, or HMC disaster to name a few—is any indication of his brash attitude, then it is clear to me that Yellen would be the better chair.

Idrees M. Kahloon '16 is a Crimson editorial writer in Dunster House.

Read more in Opinion

Never Trust an Unreleased StudyRecommended Articles

-

Stormy SummersPart of the responsibility of Fed chairman is to keep the markets calm, and we have doubts that the colorful Summers can maintain the staid and sober disposition necessary for the position.

-

Summers Withdraws His Name from Consideration for Fed Chair

Summers Withdraws His Name from Consideration for Fed Chair -

Long Live the QueenYellen has the ability to strengthen the outlook of multiple currencies at the same time.

-

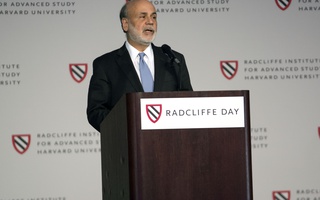

Janet Yellen to Receive Radcliffe Medal in MayJanet L. Yellen, Chair of the Board of Governors of the Federal Reserve System, will receive the Radcliffe Medal in May in recognition of her work in guiding the nation’s economy.

-

Federal Reserve Chair Yellen Awarded Radcliffe Medal

Federal Reserve Chair Yellen Awarded Radcliffe Medal