While mostly frustrating and depressing, the ongoing debate over how to handle the expiring Bush tax cuts has been educational in at least one way. I honestly did not realize how many people think someone earning $250,000 a year does not qualify as “rich.” The cutoff is important, as the Obama administration is proposing letting tax cuts on those above that income expire, but some in Congress are insisting that people who make more than about 98 percent of Americans aren’t wealthy. Jim A. Himes ’88, a congressman from Connecticut and, relevantly, a former Goldman Sachs vice president, said that $250,000 a year doesn’t make one “really rich.” Senate Minority Leader A. Mitch McConnell introduced a plan to extend all the Bush cuts—and increase the national debt by $4 trillion–by claiming Obama’s plan would target “the people who’ve been hit hardest by this recession” (a claim he later was forced to retract, excuse me, “clarify”).

Suffice it to say, if you’re making over $250,000 a year, you have not been hit harder than the millions of workers who’ve run out of unemployment benefits or the tens of thousands of families who have been forced into homeless shelters over the past two years. And if you’re making that much and still inclined to deny your place among the rich, stop. Just stop. Just 2.1 percent of households earn over $250,000 a year. They earned almost five times the income–$52,029–of the median household in 2008. As writer Daniel Gross says, “You’re rich. Get over it.”

That said, the delusion that $250,000-a-year earners aren’t rich has its causes. Most importantly, the happiness one gains from income comes not from its objective benefits so much as from where it places the income-earner in relation to his neighbors. This point, stressed most prominently by the economist Robert H. Frank, is called the “relative income effect” and has a large empirical literature backing it up, a literature that also suggests relative income affects happiness much more than absolute income. What’s more, the economist Michael T. McBride has found that the effect is stronger among high-income individuals. Put more simply, having money doesn’t make us happy. Having more money than our neighbors makes us happy. And having more money than our neighbors makes us especially happy if we have a lot of money, period.

Obviously, people earning $250,000 a year are making a lot more than most people. But the gap between them and those making even more–the super-rich–has actually grown faster than the gap between the merely rich and the middle class. Data compiled by the economists Thomas Piketty and Emmanuel Saez, and available at Saez’s website, shows that, since 1970, the percentage of total income held by the top ten percent of household has increased from 31.6 percent to 45.6 percent and that held by the top five percent from 20.4 percent to 33.4 percent. But the gains within the top five percent are even more dramatic. The top one percent more than doubled its share, from 7.8 percent to 17.7 percent. So did the top half of one percent, from 5.2 percent to 13.8 percent. Most shockingly of all, the top 0.01 percent of households, representing one ten thousandth of the nation, went from having 0.53 percent of the country’s wealth to having 3.34 percent. The biggest gains, then, go not to the rich but to the super-rich. When the even wealthier are moving ahead faster than they are, it’s easy for the merely rich to feel somehow beleaguered.

Luckily, there is a way to constructively harness this resentment and in the process tamp down on this kind of out of control income inequality. The current top tax bracket—35 percent now, 39.6 percent if the high-income Bush tax cuts expire—affects income above $379,650. Thus, some of the merely rich are taxed at the same marginal rate as the super-rich, allowing runaway inequality and stoking resentment among the merely rich.

There’s no reason we can’t create still higher tax brackets for people making over $600,000, over $1,000,000, over $1,500,000, and so forth. In fact, there is no reason we cannot create infinite tax brackets by setting a tax function and taking the integral to find each person’s tax burden. This would require computerized returns, of course, but if the Internal Revenue Service sent pre-filled out returns to taxpayers, as Obama advisor Austan D. Goolsbee has proposed, that would not be a problem. The government already knows what income most taxpayers receive and what deductions they can take before they file. It would be simple enough to have the IRS do our taxes for us, mail them to us to confirm, and spare taxpayers from doing the calculus needed.

While there’s little sign that integrals will find their way into our tax policy anytime soon, there are reports that Congressional Democrats are considering a “millionaire’s” tax bracket for high earners. That would go a long way toward solving our debt problem, and keep the super-rich from pulling still further ahead.

Dylan R. Matthews ’12, a Crimson editorial writer, is a social studies concentrator in Kirkland House. His column appears on alternate Tuesdays.

Read more in Opinion

Misguided RemarksRecommended Articles

-

Friends with Money, and PrinciplesJames K. McAuley’s editorial comment (“Friends with Money,” Mar. 8, 2010) was crude and ill thought out.

-

Unequal and Un-AmericanOur unequal society has now reached an economic crisis point, with America’s poor and middle classes failing to make ends meet.

-

Freshman Takes Baseball Roots into Rink

Freshman Takes Baseball Roots into Rink -

Frank Rich Discusses Modern Journalism

Frank Rich Discusses Modern Journalism -

Jobs and CapitalismJobs was a model of wealth acquired not due to highly leveraged, socially prestigious gambling, but due to actual inventiveness.

-

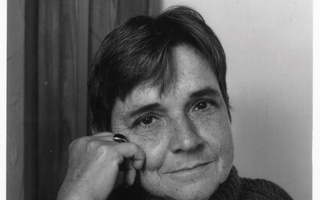

Feminist Poet Adrienne Rich ’51 Dies at 82

Feminist Poet Adrienne Rich ’51 Dies at 82