Harvard’s endowment grew slower than was average for endowments at American colleges and universities in fiscal year 2016, according to a recent report from the National Association of College and Business Officers.

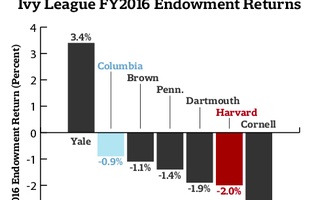

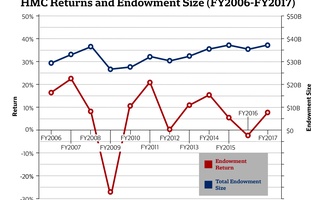

The report found that the national average for endowment returns for higher educational institutions in fiscal year 2016 was negative 1.9 percent—a marked decrease from the positive 2.4 percent universities returned on average in fiscal year 2015. In fiscal year 2016, Harvard returned negative 2 percent on its investments, the worst the University has returned since the height of the financial crisis in 2009.

The release of the study—which aggregates endowment data from over 800 colleges and universities across the country—comes just a week after N.P Narvekar, the new chief of Harvard’s investment arm, announced sweeping changes to the University’s unique investment model. Among other actions, Harvard Management Company will cut the firm’s workforce in half and eliminate most of its internal money management teams.

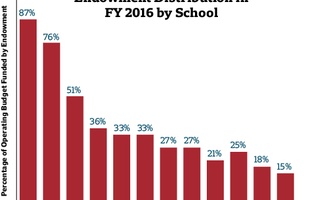

Despite lackluster returns nationwide, the report notes that schools continued to increase the annual payout from the endowment to annual operating budgets in fiscal year 2016, a trend which the association’s CEO John D. Walda described as “a cause for concern.”

“Continued below-average investment returns will undoubtedly make it much more difficult for colleges and universities to support their missions in the future,” Walda wrote in an executive summary of the association’s report.

In fiscal year 2016, HMC allocated approximately $1.7 billion of its endowment towards the University’s operating budget, contributing to an overall decline in the value of the endowment from $37.6 billion to $35.7 billion.

Typically, most institutions must earn about 7.4 percent on their investments annually in order to maintain the level of endowment money they spend, according to the report. Last year, after Harvard’s endowment returns became public, University President Drew G. Faust said the poor returns would likely constrain Harvard’s budgets for years to come.

Charles A. Skorina, who manages a financial executive search firm, said that “most universities have not done as good a job as they should in controlling their budgets.”

“Harvard was irrationally exuberant a few years ago over what they could fund, thinking the money pot in their endowment would just keep growing,” Skorina said.

William F. Jarvis, the executive director of the Commonfund Institute, charged universities with balancing the long and short term demands of their budgets “at the governance level” in order to maintain the services they offer students—financial aid, research opportunities, among others—in perpetuity.

—Staff writer Brandon J. Dixon can be reached at brandon.dixon@thecrimson.com. Follow him on Twitter @BrandonJoDixon.

Read more in University News

Rent for Harvard Apartments Will Increase 3 Percent On AverageRecommended Articles

-

Yale Earns 3.4 Percent On Investments, Beating HarvardIn a rough year for university endowments, Yale returned 3.4 percent on its investments in fiscal year 2016, beating out Harvard’s negative 2 percent returns over the same time period.

-

Columbia Returns -0.9 Percent with Narvekar, Next HMC Head

Columbia Returns -0.9 Percent with Narvekar, Next HMC Head -

Schools Will be 'Differentially' Affected by Endowment Returns, Faust Says

Schools Will be 'Differentially' Affected by Endowment Returns, Faust Says -

Financial Woes Slow House Renewal

Financial Woes Slow House Renewal -

Corp. Sets Minimum Endowment Distribution Amid Financial Constraints

Corp. Sets Minimum Endowment Distribution Amid Financial Constraints