{shortcode-c28dadbf62c48a52d82e2dfc66babe0b85045378}Yale University—the Ivy League school known for consistently leading the pack in annual investment returns—returned 11.3 percent on its investments for fiscal year 2017.

The returns trail behind other peer institutions, though they topped Harvard's. Dartmouth College leads the Ivy League with 14.6 percent returns, while the University of Pennsylvania and Brown returned 14.3 percent and 13.4 percent, respectively. Only Columbia has yet to release its results.

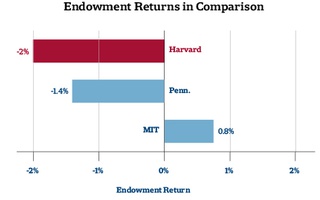

While it may not be at the top of the class this year, Yale still managed to outperform Harvard, which posted a “disappointing” 8.1 percent on its endowment investments this fiscal year. Historically, the two endowments have been the envy of the higher education financial world, but in recent years, Harvard Management Company has fallen behind.

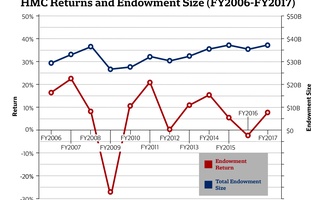

The Harvard endowment is now valued at $37.1 billion, roughly $10 billion more than Yale’s.

For a long time, the two endowments were structured in fundamentally different ways. Harvard used a “hybrid” model that leveraged internal money managers with some external talent. Yale, on the other hand, outsources the majority of its assets to external managers.

In the last year, Harvard has moved closer to that model as HMC’s endowment chief N.P. Narvekar embarks on an ambitious restructuring of the firm’s investment strategy. The majority of its teams have been outsourced, with only a few high-performing teams remaining in house. Nearly half of the firm’s staff—which, at around 230, was unusually large for a college endowment—will be laid off by the end of the calendar year.\

—Staff writer Brandon J. Dixon can be reached at brandon.dixon@thecrimson.com. Follow him on Twitter @BrandonJoDixon.

Read more in News

Law Review Elects First Ever Majority Female ClassRecommended Articles

-

Harvard Loses Almost $2 Billion in Endowment Value

Harvard Loses Almost $2 Billion in Endowment Value -

Necessary ChangeIf Harvard cannot at least match the financial success of peer institutions, it cannot expect to keep its role as a leader in research and higher education.

-

With an External Real Estate Team, HMC May Face Increased Fees

With an External Real Estate Team, HMC May Face Increased Fees -

Harvard Returns 8.1 Percent in ‘Disappointing’ Fiscal Year 2017

Harvard Returns 8.1 Percent in ‘Disappointing’ Fiscal Year 2017 -

Harvard’s Endowment Returns, Explained

Harvard’s Endowment Returns, Explained