UPDATED: May 23, 2016, at 12:05 p.m.

Harvard Management Company CEO Stephen Blyth will take a temporary medical leave of absence starting May 23, the University announced Monday.

Robert A. Ettl, HMC’s Chief Operating Officer who joined the company in 2008, will serve as the interim CEO of Harvard’s investment arm. {shortcode-41cac449c6b9455a1d42584cabc1638aff1cd227}

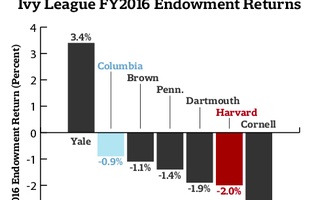

Blyth’s absence comes in the middle of his second year at the helm of HMC, which manages Harvard’s $37.6 billion endowment. Under Blyth’s tenure, HMC has taken a number of steps to change its investment strategies and match returns that peer institutions earn on their endowments. In the last few years, Harvard’s endowment has grown at a slower rate than the investment pools of several peer institutions, including Princeton, MIT, and Yale.

“We have a highly-experienced executive team at HMC and, together with Bob, they will provide strong leadership in Stephen's absence” Paul J. Finnegan, Chair of HMC’s Board of Directors and the treasurer of the Harvard Corporation, the University’s highest governing body, wrote in a statement. “We look forward to Stephen's return to the company, and wish him well as he returns to full health."

The University has not specified a reason for the medical leave of absence.

Check thecrimson.com for more updates.

Read more in News

LBJ Wants Your GPA: The Vietnam ExamRecommended Articles

-

HMC Loses Senior Hire to Private SectorJohn Devir, a highly touted recent hire, will not be joining Harvard Management Company and has instead accepted an offer at a California firm.

-

End 180:1One hundred eighty to one represents the ratio of the highest-paid Harvard employee’s salary to the lowest. For a university with a $32 billion endowment, this wage disparity is ridiculous and embarrassing, and Harvard must amend it not only by ensuring good jobs for Harvard’s lowest-paid workers, but also by significantly reducing top executive compensations.

-

Wiltshire Will Leave Harvard Management CompanyAndrew G. Wiltshire joined HMC—the University’s investment arm that oversees its $35.9 billion endowment—in 2001 as a natural resource specialist.

-

Management Company Adds Jain to BoardRobert Jain, an investment banker at Credit Suisse, joined the Harvard Management Company in March as the newest member of the board of directors, the fourth person added to the body since last August.

-

Columbia Returns -0.9 Percent with Narvekar, Next HMC Head

Columbia Returns -0.9 Percent with Narvekar, Next HMC Head