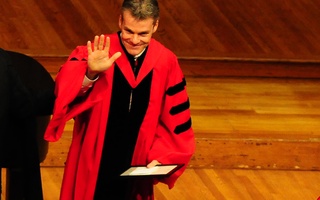

Robert Jain, an investment banker at Credit Suisse, joined the Harvard Management Company in March as the newest member of the board of directors and the fourth person added to the body since last August.

In March, Jain announced he would be leaving his role as global head of Credit Suisse Asset Management in June to join Millennium Management, a hedge fund, as its co-chief investment officer.

“We are very pleased to add Bob who just joined and attended his first meeting in March,” Paul J. Finnegan ’75, the University’s treasurer, wrote in an email.

At Credit Suisse, Jain oversees the investment bank's $325 billion money management division, managing the assets of large pension funds, private foundations, and other institutions with significant endowments.

Jain became known at Credit Suisse for reinventing the firm’s asset management division, taking a “boutique” approach to its targeting of clients by focusing on the sovereign wealth fund sector of the asset management business.

Since Stephen Blyth took over as President and CEO of the Management Company in January 2015, HMC—which oversees the University’s $37.6 billion endowment—has seen major reorganization, both in terms of personnel as well as investment policy.

In recent years, Harvard’s endowment performance has come become a source of concern for consistent underperformance relative to peer institutions. Blyth took over for Jane L. Mendillo with the goal of increasing returns.

On the personnel side, HMC has added four new members to its board, increasing the total number of board members. In addition to Jain’s appointment this month, the Management Company added Economics professor and former Federal Reserve board member Jeremy C. Stein and Joshua S. Friedman, founder of private equity firm Canyon Partners, last August.

In the fall, the Management Company added Amy C. Falls, the chief investment officer of Rockefeller University. In addition, long-time HMC portfolio manager and head of alternative assets Andrew G. Wiltshire retired at the end of 2015 after 14 years at the Management Company, where he played a major role in its investments in timberlands and forests.

Last September, Blyth announced plans for a overhaul of HMC’s method of fund allocation, calling for a risk factor-based approach. The impact of the changes will be available for the first time in September 2016, when his first full fiscal year of investment results will be released.

—Staff writer William C. Skinner can be reached at william.skinner@thecrimson.com. Follow him on Twitter @wskinner.

Read more in University News

$21 Million Gift Launches Center for Health and Happiness