Longtime Harvard Management Company investor Andrew G. Wiltshire will retire from his position as alternative assets manager later this year.

Wiltshire joined HMC—the University’s investment arm that oversees its $35.9 billion endowment—in 2001 as a natural resource specialist. During his time at HMC, he grew Harvard’s natural resources investment portfolio, which delivered an annual return of 11.6 percent over the 10-year period from June 30, 2004 to June 30, 2014, according to the press release.

Wiltshire spearheaded HMC’s timberland investment strategy, which began in 1997 and expanded greatly under the guidance of former President and CEO Jane L. Mendillo. Harvard’s timber investments, though, fell into controversy after a former contractor for Harvard’s 33,00-acre plot of forest in Romania was arrested on bribery and money laundering charges in January 2014. Soon after, Harvard put the Romanian timberland up for sale, and it was acquired by Ikea Group this summer.

“Andy was a pioneer in developing HMC’s timberland strategy and innovative natural resources portfolio, and was a vital member of the HMC management team that helped Jane Mendillo lead the organization through the financial crisis and its aftermath,” HMC President and CEO Stephen Blyth said in a press release.

Like other university endowments, Harvard’s took a significant hit during the 2009 global financial crisis, an investment lag from which it has still been trying to recover. Mendillo’s tenure as leader of HMC ended abruptly in 2014 when she resigned after a turbulent six-year stretch that rendered subpar returns.

Wiltshire, 58, has consistently been among HMC’s top-paid executives, who are compensated on a performance-based system linked to overall investment performance. He made $8.5 million in 2013, according to Internal Revenue Service tax filings.

—Staff writer Mariel A. Klein can be reached at mariel.klein@thecrimson.com. Follow her on Twitter@mariel_klein.Read more in University News

Ralph Nader Accuses Law School of Servicing Corporate GreedRecommended Articles

-

HMC Loses Senior Hire to Private SectorJohn Devir, a highly touted recent hire, will not be joining Harvard Management Company and has instead accepted an offer at a California firm.

-

End 180:1One hundred eighty to one represents the ratio of the highest-paid Harvard employee’s salary to the lowest. For a university with a $32 billion endowment, this wage disparity is ridiculous and embarrassing, and Harvard must amend it not only by ensuring good jobs for Harvard’s lowest-paid workers, but also by significantly reducing top executive compensations.

-

Endowment Returns 5.8 Percent, Growing to $37.6 Billion

Endowment Returns 5.8 Percent, Growing to $37.6 Billion -

Management Company CEO Takes Temporary Medical Leave

Management Company CEO Takes Temporary Medical Leave -

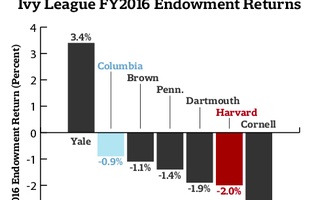

Columbia Returns -0.9 Percent with Narvekar, Next HMC Head

Columbia Returns -0.9 Percent with Narvekar, Next HMC Head