Continuing a line of major changes at Harvard Management Company, two high-level managers departed recently with little notice.

The departures of eight-year fixed-income manager Marco C. Barrozo and Satu Parikh, who joined HMC in 2011 as managing director and head of commodities, were first reported in The Boston Globe Friday, which cited an internal email to HMC employees.

In an endowment update at the end of September, HMC president and chief executive officer Stephen Blyth praised Parikh for his contribution to the 3.5 percent return earned by the natural resources and commodities team, writing that “the positive return from our commodity relative-value team led by Satu Parikh was impressive, and indicative of our ability to extract value from volatile and distressed markets, agnostic of market direction.”

In the update, Blyth credited the fixed income team for its “long-term, consistent run of outperformance,” but did not mention Barrozo by name.

For the time being, Barrozo and Parikh’s responsibilities will be absorbed by other managers, according to the Globe. HMC will also have another vacancy at the end of the year, as Andrew G. Wiltshire recently announced his plans to retire from his alternative assets managership.

University spokesperson Jeff Neal did not respond to a request for comment on Sunday.

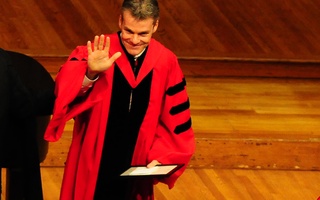

The departures come shortly after Harvard’s endowment rose to $37.6 billion, but with a 5.8 percent overall return trailed the rates of many peer Universities. Blyth, who took up the position in January after Jane L. Mendillo stepped down, promised serious changes at HMC in a letter to alumni last month.

“HMC must remain competitive for Harvard itself to confidently maintain its own preeminence as a University,” Blyth wrote. “However, recent performance against [the top 10 endowments] metric has been disappointing.”

Blythe listed performing in the top quartile of the top 10 university endowments as one of his goals . Last year, Stanford, Massachusetts Institute of Technology, and Yale respectively notched 7 percent, 13.2 percent, and 11.5 percent returns on their endowments.

Under Mendillo’s leadership, Harvard did not fare well against other large endowments, often beating internal benchmarks but lagging behind its peers.

One point of controversy surrounding HMC is its compensation model, in which executives made multiples more than University President Drew G. Faust’s salary while not boasting better endowment returns than other institutions. Blyth wrote in his letter that he plans to tie in compensation more with fund-wide performance, rather than solely judging managers on individual returns. In 2013, Blythe earned $11.5 million in compensation.

—Staff writer Theodore R. Delwiche can be reached at theodore.delwiche@thecrimson.com. Follow him on Twitter @trdelwic.

Read more in University News

South Carolina Governor Nikki Haley Honored for Flag RemovalRecommended Articles

-

Endowment Returns 5.8 Percent, Growing to $37.6 Billion

Endowment Returns 5.8 Percent, Growing to $37.6 Billion -

Endowment Returns Outpace National AverageFor the first time since the 2012 fiscal year, Harvard’s endowment grew at a faster rate than the national average for American colleges and universities in FY 2015.

-

Faust Made $1.2 Million in 2014Harvard Management Company CEO Stephen Blyth made less in 2014 as head of public markets than he did the previous year in that position, while University President Drew G. Faust earned more than she did in 2013.

-

HMC Chief Executive Search Narrows

HMC Chief Executive Search Narrows -

Former HMC Chief Returns to Teaching Role

Former HMC Chief Returns to Teaching Role