UPDATED: September 24, 2014, at 6:40 p.m.

Stephen Blyth will be the next president and chief executive officer of Harvard Management Company, the University’s investment arm which manages its $36 billion endowment.

Blyth, who is currently a managing director and head of public markets at HMC as well as a professor of statistics, will assume the role Jan. 1, 2015. He will manage the largest university endowment in the world, which, as reported yesterday in HMC’s annual report, currently sits at $36.4 billion.

{shortcode-3d5412c7a93fce4d5bc8009debf493e5a6d6a85a}

He will succeed Jane L. Mendillo, who announced in June her decision to end her eight-year tenure at the helm of HMC.

University Treasurer Paul J. Finnegan ’75, a member of the Harvard Corporation and of the search committee that picked Blyth, said in an interview Wednesday afternoon that the search committee “had a very strong pool, and Stephen rose to the top.”

“Stephen is a terrific candidate, and we’re delighted with the opportunity he now presents,” Finnegan said. He would not say when the appointment was finalized and directed further questions to the University’s press release. The Corporation met on Monday for a regularly monthly meeting with Mendillo in attendance.

The search for Mendillo’s replacement was led by James F. Rothenberg ’68, Harvard’s treasurer from 2004 until earlier this year and the current chairman of HMC’s board. Rothenberg said last week that the list of candidates was short at that point, but he declined to give further specifics. Other HMC board members participated in the search, according to Finnegan, but Mendillo said that she herself did not.

Blyth joined HMC in 2006 upon leaving Deutsche Bank, where he served as managing director and head of its global rates proprietary group in London. Before that, he was a managing director of Morgan Stanley’s interest-rate group in New York.

In his role as head of public markets, Blyth has overseen the fixed income and public equities asset classes, which approximately totals 43 percent of HMC’s portfolio, according to the annual report.

Fixed income in particular has historically been a strong driver of growth for the HMC’s portfolio, with an annualized return over the past 20 years of around 11 percent, more than 4 percentage points above its internal benchmark. It surpassed its benchmark this year by 3.5 percentage points.

Blyth said in an interview on Wednesday that HMC’s aim for creative and innovative investments is a strategy that spans all asset classes.

“The most important thing is for HMC as an institution to be in the position to exploit opportunities as they arise,” he said. “Market opportunities always evolve, and we just need to be appropriately positioned and staffed so we can identify and exploit those opportunities as they arise in whichever areas of the markets they may arise.”

In the past year, HMC has experienced a string of departures of top-level investors, including managing directors in private equity and fixed income. Blyth acknowledged that strong investors would inevitably receive opportunities elsewhere but said that he believes that HMC has unique draw as an employer.

“At heart people believe in the mission of HMC and that is an incredibly strong attraction for people to come and work here,” Blyth said. “I’m bullish on our ability to continue to build a great team.”

Read more in University News

Professors Argue for Change in Organ Donation GuidelinesRecommended Articles

-

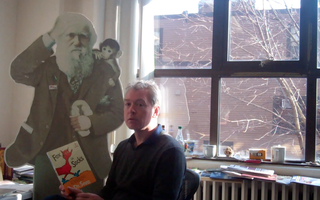

Berry, Pinker, and Blyth Wish Dr. Seuss a Happy Birthday

Berry, Pinker, and Blyth Wish Dr. Seuss a Happy Birthday -

Endowment Returns 5.8 Percent, Growing to $37.6 Billion

Endowment Returns 5.8 Percent, Growing to $37.6 Billion -

Endowment’s Performance Is Concerning, Faust Says

Endowment’s Performance Is Concerning, Faust Says -

Endowment Returns Outpace National AverageFor the first time since the 2012 fiscal year, Harvard’s endowment grew at a faster rate than the national average for American colleges and universities in FY 2015.

-

Blyth Resigns as Management Company CEO

Blyth Resigns as Management Company CEO